Why Housing, Healthcare, and Education Costs Keep Rising?

Rich Flanery, CMPS® Broker Owner, Peak Capital Mortgage, NMLS#25611

⚡ The Triple Threat: Regulation, Supply Caps and Subsidies

Rising housing, healthcare, and education costs are putting pressure on families everywhere. While your smartphone gets cheaper and faster, the price to live, heal, and learn keeps climbing. Why? The answer lies in outdated government rules, limited supply, and too little tech..

Marc Andreessen, a leading voice in tech and investing, nailed it. He says the reason these costs explode is because of overregulation, capped supply, and taxpayer money pumping up demand. Let’s break down how these three giants of your budget became so bloated—and how smart innovation like AI and blockchain can help us fix it.

🏠 The Housing Market: Wrapped in Red Tape and Fees

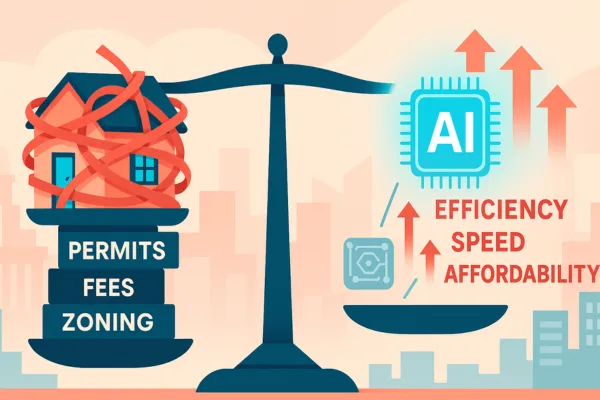

Permits, Zoning, and Endless Paperwork Are Pushing Prices Up

Before builders can pour a single drop of concrete, they’re hit with a mountain of zoning rules, fees, environmental reports, and permits. These aren't just safety checks—they’re revenue machines for local governments. All these hoops delay construction and jack up prices for everyday homebuyers.

Even selling an existing home isn’t easy. The mortgage loan system is stuffed with layers: loan officers, processors, underwriters, closers, funders, post-closers, and servicers. It’s like a bureaucratic relay race—every handoff slows the process and raises costs.

🏗️ What If Buying a Home Was as Easy as Booking a Flight?

Blockchain Could Make Mortgages Cheaper and Faster

Imagine a mortgage process that takes hours, not months. That’s the promise of blockchain—a secure digital ledger that cuts out the middlemen. With smart contracts, buyers and sellers could finalize deals transparently and instantly.

And AI? It could analyze risk, verify income, and flag errors in seconds. Less human error. Less paperwork. More homes sold faster—at lower cost.

🏥 Healthcare and 🎓 Education: Subsidies That Backfire

Free Money Can Drive Up Demand—But Not Supply

The government spends billions to help with insurance and student loans. Sounds great, right? But here’s the catch: More people can afford services, but there aren’t more doctors or more seats in classrooms. When demand rises and supply doesn’t, prices shoot up.

Plus, both sectors are buried in red tape. Hospitals and universities must follow endless regulations, slowing innovation and raising admin costs. The result? More money spent on overhead, less on actual care and teaching.

💡 Tech Is the Cure for These Sick Systems

From Telemedicine to Digital Classrooms, The Tools Already Exist

Healthcare and education don’t need more money—they need better tools. Telehealth visits, AI diagnostics, and digital medical records can slash costs and save lives. In education, online learning and AI tutors can make college affordable again.

But too many leaders resist these changes. Accreditation boards, unions, and outdated laws all fight to keep things “the way they’ve always been.” And that’s costing all of us.

🧩 The Fix Is Simple—If We’re Brave Enough to Make It

Cut the Red Tape. Embrace Innovation. Lower the Cost of Living.

To fix the rising cost crisis, we must:

Simplify regulations. Too many rules protect no one and hurt everyone.

Streamline housing approvals. Stop using them as ATMs.

Adopt new tech. Blockchain, AI, and automation can do the heavy lifting.

When we combine smart policy with modern tools, we unlock lower prices, faster services, and more opportunities for everyone.

✅ Conclusion: You Deserve Better—And It’s Possible

High housing, healthcare, and education costs aren’t just “how it is.” They’re the result of broken systems and fear of change. But there’s hope. By cutting red tape and embracing tech, we can make life more affordable, faster, and better.

Let’s build a future where your paycheck goes further—and where innovation works for all of us, not just the lucky few.

🔍 Frequently Asked Questions (FAQs)

Q1: How does AI help reduce housing costs?

AI speeds up mortgage approvals, spots errors instantly, and makes underwriting cheaper—cutting down overall costs for buyers.

Q2: What’s the biggest regulatory burden in new home building?

Zoning laws and permitting delays are top culprits. They restrict supply and raise costs long before construction begins.

Q3: Why hasn’t healthcare adopted more technology?

Healthcare is tied up in strict rules and legacy systems. Many providers resist change due to compliance risks and training costs.

Q4: Can blockchain make education more affordable?

Yes. Blockchain can streamline student loan processing, reduce fraud, and even verify degrees—cutting admin costs and boosting transparency.

Q5: Are subsidies always bad for prices?

Not always, but without boosting supply, subsidies can overheat demand—making services like college and healthcare even more expensive.